Most entrepreneurs are obsessed with going fast.

We're the Tom Cruise types—need for speed, little bit dangerous, and always pushing the limits. We're wired to chase chaos, take risks, and break through barriers. I know because I'm one of you.

But what if I told you that you've been thinking about speed all wrong? What if everything you know about risk and reward is backwards?

The Snowmobile Paradox

Every winter, I strap on my gear and head into the mountains on my snowmobile. When snowmobilers get together, we talk about one thing: horsepower. How many CCs, what mods we've made, how fast we can climb.

What we don't talk about? The four pairs of gloves, two radios, backup goggles, avalanche beacons, and protective gear I take on every ride. Nobody posts Instagram photos of their knee pads.

But here's the uncomfortable truth: without that protective gear, my $35,000 snowmobile would sit unused in the garage. That's right—my favorite thing in the world would be nothing but an expensive paperweight.

Protection isn't what slows you down. Protection is what gives you permission to go full throttle.

This is the paradox most entrepreneurs miss. We think protection—financial safety nets, structured planning, risk mitigation—is boring as hell. We think it holds us back from the real action. After all, we didn't get into business to play it safe.

But imagine taking that snowmobile out in a t-shirt in subzero temperatures. How fast would you really go? How long before frostbite sets in? How many risks would you actually take?

Zero. You'd be miserable, terrified, and headed back to the lodge within minutes.

The Thousand-Horsepower Problem

Picture this: You've just dropped serious cash to rent a 1,000-horsepower supercar. It's the ride of your dreams—carbon fiber everything, acceleration that pins you to your seat, handling that feels like it defies physics.

You set your alarm early, barely sleep from excitement, and wake up the morning of your reservation. You pull back the curtains... and see six inches of fresh snow covering everything.

Question: How much of that 1,000 horsepower can you actually use?

The answer? Zero. Absolutely none. You'd be lucky to make it down the driveway.

This isn't just a hypothetical—it's the perfect metaphor for where most entrepreneurs find themselves. All the capability in the world—brilliant ideas, relentless work ethic, bold vision—but lacking the certainty needed to deploy it.

Your business is the supercar. Certainty is your road condition. Without it, your horsepower means nothing.

Think about it: How many opportunities have you passed on because you weren't sure if you could handle the downside? How many risks have you avoided because you didn't have enough certainty in your financial foundation?

That's not just theory—it's costing you millions.

The Chaos Addiction

Here's where most of us go wrong: when we hit a ceiling, our entrepreneurial instinct is to add more chaos.

Business struggling? Work harder. Revenue flat? Launch more products. Feeling stuck? Take bigger risks.

I get it. It feels right. After all, what got us here was taking risks, pushing boundaries, and saying yes when others said no. We taste success through chaos, and we become addicted to it.

But there's a brutal truth: adding chaos to chaos just creates bigger chaos.

I learned this lesson the hard way. For years, I operated on the belief that more risk equals more reward—that success was just on the other side of the next big leap. And sometimes, it worked! That's what made it so seductive.

But I was missing the yang to my yin. The order to balance the chaos.

Think about it like a kite. I once took my daughter flying kites, and she kept asking to cut the string. "Dad, if we cut it, it'll fly even higher!" So I cut it. Want to guess what happened? The kite didn't soar—it crashed. The very constraint she thought was holding it back was actually what allowed it to fly.

The same is true in your business and wealth strategy. You can only expand into chaos to the extent that you've built certainty beneath you. Without that foundation, you're not being brave—you're being reckless.

Freedom From vs. Freedom To

At Thanksgiving last year, I sat around a table with my extended family. Everyone was sharing their accomplishments—my brother-in-law ran a marathon, my sister got a promotion, my cousin finished grad school.

When it came to my turn, I stayed silent.

Not because I didn't have anything to share. Quite the opposite. I'd rebuilt a business from scratch, assembled an incredible team, and hit seven figures in annual revenue.

But I couldn't share any of that. In that room, with those people, business success wasn't celebrated—it was seen as bragging about money.

I felt completely alone in a room full of people.

This gets at something deeper about entrepreneurship. Most of us start with "freedom from"—freedom from a boss, from a paycheck, from constraints. That negative freedom gets us started, but it's ultimately empty.

True sovereignty comes from "freedom to"—freedom to pursue bigger opportunities, to take calculated risks, to build something lasting. Freedom to share your success without apology. Freedom to create impact on your terms.

This isn't just philosophical—it changes everything about how you build wealth.

Traditional financial advice tells you to save for retirement so you can eventually escape work (freedom from). That's why they push 401(k)s and traditional retirement accounts that lock up your money for decades.

But entrepreneurial wealth building is about creating assets that expand your capacity to create impact now (freedom to). It's about building floors beneath you, not ceilings above you.

One is an escape strategy. The other is a growth strategy.

Which one are you pursuing?

The Super Bowl Ring

How do we measure success in sports? Championships.

Dan Marino and Tom Brady had nearly identical regular-season stats. But Brady has seven rings, and Marino has zero. When their careers ended, no one talked about Marino's impressive passing yards—they talked about Brady's championships.

In sports, once a champion, always a champion. You could retire as the worst player in the league, but if you have a ring, you're remembered as a champion.

In business? The opposite is true. You could build an incredible company, create massive value, and impact thousands of lives. But if that business eventually fails? That's what people remember.

Unless you have your Super Bowl ring.

For entrepreneurs, that ring is cash flow freedom—assets that generate income without requiring your time, attention, or business success.

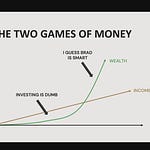

Your business can make you rich. Only assets can make you wealthy.

The Monkey in the Middle

Let me share a painful realization from my own journey. Years ago, I tried to be my own marketing director. I was drowning—talking directly to copywriters, designers, funnel builders, media buyers, and social media managers. Everyone needed something from me yesterday.

Russell Brunson finally sat me down and said, "Dude, you need a marketing officer. One person to talk to all these people for you."

It was a forehead-slapping moment. Of course! In business, we hire leaders to coordinate teams so we can focus on what matters. That's Business 101.

Yet when it comes to wealth, I see successful entrepreneurs making the exact same mistake.

You become the monkey in the middle—juggling demands from your:

Accountant who needs tax documents

Attorney who needs decisions on structures

Investment advisor pushing the latest opportunity

Insurance agent with policy questions

Banker asking about loans

Bookkeeper needing categorizations

And there you are, caught in the crossfire, while your actual business—you know, the thing making all the money—gets your leftover attention.

It's an impossible game. And it's precisely why most entrepreneurs—even seven-figure ones—fail to build lasting wealth.

The solution isn't becoming a financial expert or working harder. It's having a Chief Wealth Officer—someone who coordinates all these moving parts so you don't have to.

Why would you handle wealth differently than any other critical area of your business?

Return on Attention vs. Return on Investment

Let me shatter another myth: for entrepreneurs, the highest returns aren't always the best investments.

Heresy, right? But hear me out.

Most financial advisors obsess over ROI—Return on Investment. That's because they're selling products, not solving your actual problem.

For entrepreneurs, there's a far more crucial metric: ROA—Return on Attention.

Your most scarce resource isn't capital—it's attention. Period. Whatever pulls your focus away from your zone of genius costs you far more than money. It costs you opportunity.

Let me make this painfully concrete: If I offered you an investment with a guaranteed 50% annual return, but it required 10 hours of your attention each week, would you take it?

If you said yes, do the math. Ten hours weekly is 520 hours annually. At the profit level of most entrepreneurs in this community, those 520 hours in your business would generate exponentially more than a 50% return on investment.

This is why chasing the highest returns is often exactly the wrong strategy. The best investments for entrepreneurs are the ones that preserve attention while creating certainty.

When I evaluate investments for my clients, I'm not just asking "What's the return?" I'm asking "What's the return on attention?" Because that's what actually matters.

The Path to Sovereignty

I've spent the last decade obsessing over one question: why do 93% of entrepreneurs—people who create massive value and solve real problems—end up with less financial security than W-2 employees?

It's not because entrepreneurs are bad with money. It's because the entire financial system wasn't built for us. It was built for employees with predictable incomes and 40-year time horizons.

When I worked at Goldman Sachs during the 2008 crash, I witnessed something fascinating. The clients who weathered the storm weren't the ones with the fanciest investment strategies—they were the business owners who had built systems to create certainty amid chaos.

That's when I realized financial sovereignty doesn't happen by accident. It requires intention, strategy, and the right system.

At Sovereign, we've built that system through what we call the Wealth Codex—a framework designed specifically for entrepreneurs that aligns your business success with your personal wealth goals.

It answers the questions most entrepreneurs never ask:

How much profit does your business need to generate to fund your wealth goals? (Most entrepreneurs have no idea)

What tax strategy will maximize your capital efficiency? (Hint: if you're paying more than 20% in taxes, you're doing it wrong)

Where should you store wealth to protect it from volatility and liability? (The wealthy use totally different vehicles than most advisors recommend)

Which assets will create the passive income needed for true sovereignty? (It's not what Wall Street is selling)

Most importantly, it creates the certainty needed to let you go full throttle in your business without the constant fear that one bad quarter could destroy everything you've built.

Protection is Permission

Two years ago, I found myself at a crossroads.

I had built a successful business that was generating seven figures. By most standards, I had "made it." But something wasn't right.

I felt trapped. Trapped by the very success I'd created. I had spent years chasing "more"—more clients, more revenue, more growth—but I hadn't built the certainty I needed to make my next move.

So I made a choice that seemed crazy to everyone around me: I walked away from a business partnership that was generating half a million dollars annually for me. I left behind a community I'd built, an identity I'd crafted, and an income stream that most people would kill for.

Why? Because I realized I'd become so focused on the chaos—the hustle, the next deal, the growth—that I'd neglected to build the certainty I needed to truly be sovereign.

It was the hardest and best decision I've ever made.

Remember my snowmobile analogy? Protection isn't the boring part of the story—it's what makes the exciting part possible. It's not a substitute for speed—it's what gives you permission to go faster than you ever thought possible.

The same is true for your wealth strategy. Certainty isn't the opposite of entrepreneurial risk-taking. It's the foundation that makes bigger, bolder risks possible.

Without it, you're just gambling—hoping things work out while always being one bad quarter away from disaster.

With it, you're truly sovereign—free to pursue opportunities, pivot when needed, and build something that outlasts your business.

Most entrepreneurs never reach this level of freedom. They stay trapped in the cycle of making money but never building wealth. They create success but remain vulnerable to its inevitable fluctuations.

You have a choice: keep riding the edge without protection, or build the certainty that lets you go full throttle without fear.

I know which one I chose. What about you?

Live Rich. Finish Wealthy.

Brad

PS - If you only do one thing, watch the video above and tell me your biggest takeaway in the comments.

Want to talk about hiring a Chief Wealth Officer, raise your hand here.

Share this post